MUMBAI, India, May 2024 — DSP Asset Managers’ latest edition of the #DSP7Sees report underscores India’s economic stability amid global fluctuations, noting its consistent growth in economic output and business sentiment over the past year. The report, released in May 2024, contrasts India’s performance with the global slowdown in manufacturing and services, suggesting that the Indian economy is well-equipped to handle manageable levels of global turbulence.

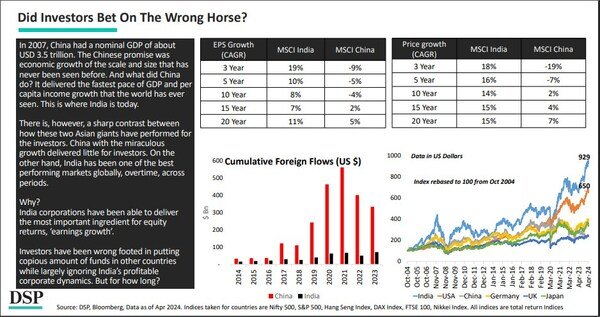

The report draws a stark comparison between the investment outcomes in India and China. Since 2007, despite China’s unprecedented GDP and per capita income growth, it has yielded minimal returns for investors. In contrast, India has emerged as one of the top-performing markets globally, driven by robust earnings growth from Indian corporations. This disparity highlights a potential oversight by investors who have heavily funded other regions while overlooking the profitable dynamics of Indian corporations.

Over the past three decades, China has seen a Compound Annual Growth Rate (CAGR) of 14% in Gross Fixed Capital Formation, outpacing India’s 8%. However, Indian growth has been coupled with higher returns on equity, distinguishing it from Chinese growth fueled by cheap domestic credit. India has recently emerged from what the report describes as an “investment winter.” The investment to GDP ratio, which had been low since peaking in 2011, is witnessing a revival bolstered by post-COVID recovery and significant government expenditure. Since independence, India has invested approximately $14 trillion, with $8 trillion in new investments over the past decade.

Despite not being the cheapest market, the steady pace of earnings growth and a favorable business cycle have kept Indian stocks in high demand, making them relative outperformers in the global arena. However, DSP Asset Managers caution that it’s difficult to predict whether India will continue to command high market multiples.

The report also sees potential in Indian financial sectors, noting particularly low Non-Performing Asset (NPA) ratios for banks and a high Provision Coverage Ratio, indicating robust asset quality and an ability to absorb potential losses. This financial health suggests that Indian banks and non-banking financial companies could offer a better investment experience moving forward.

Sahil Kapoor, Market Strategist & Head of Products at DSP Asset Managers, advises that “Valuations respecting investors need to dial down their return expectations. Lower entry valuations are the best defense for investors seeking to invest in India for the long haul,” reflecting a cautious but optimistic outlook for long-term investment in India.

About DSP Asset Managers:

DSP Asset Managers is a 100% independent & Indian Asset Management Company (AMC) with a wide range of active and passive funds managed across the risk-reward spectrum. We are backed by the DSP Group, an almost 160-year-old Indian financial giant. The family behind DSP has been very influential in the growth and professionalization of capital markets and the money management business in India over the last one and a half centuries.

Read Also : Imagination in a Disrupted Age: Navigating the Future with Curiosity and Empathy